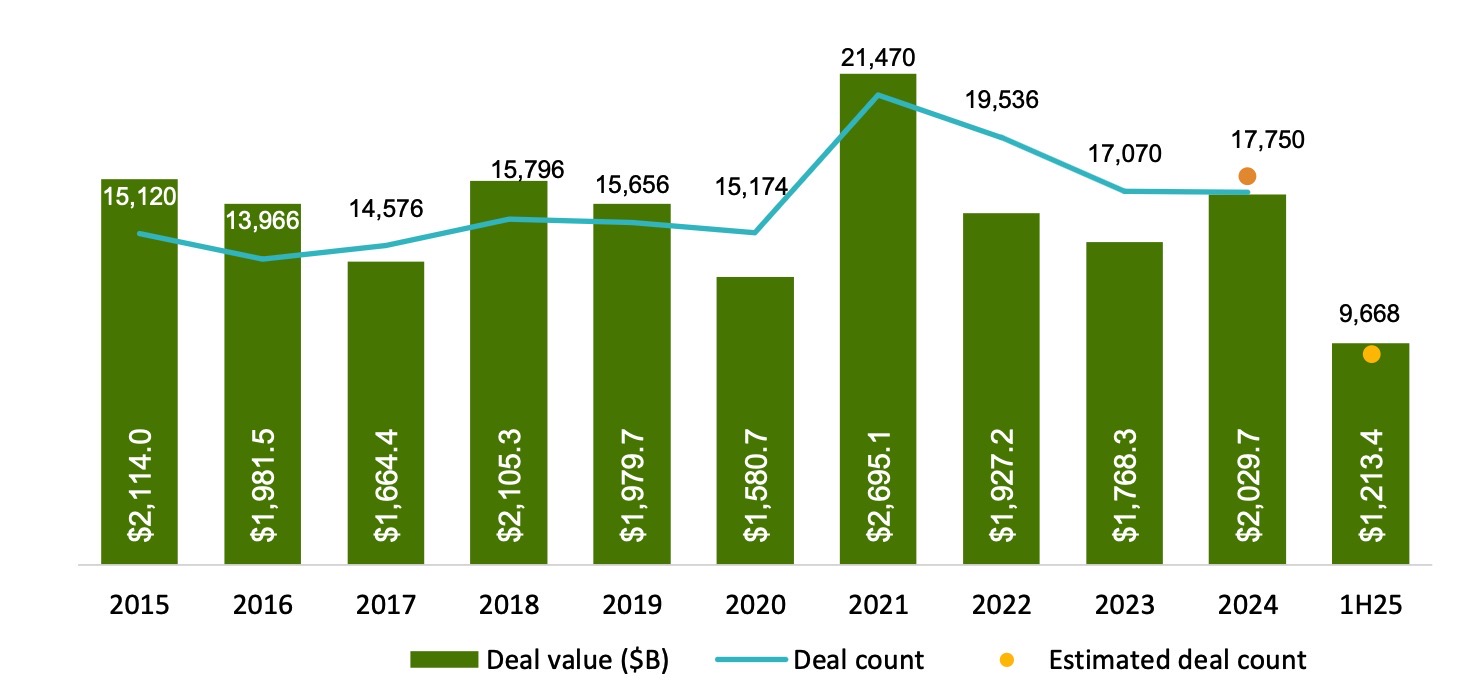

North America M&A Activity Holds Up

North American M&A deal activity demonstrated resilience during the first half of 2025 in the wake of tariff and economic uncertainty. With 9,668 deals completed in the first half as reported by Pitchbook, 2025 is on pace to surpass activity in both 2023 and 2024. Contributing to this year’s activity includes very large deals getting done and European buyers taking advantage of the weak dollar and lower rates after the ECB lowered rates twice in 2Q25. European acquirers deployed $113.2 billion in North American targets year-to-date, outspending U.S. buyers by $20.7 billion.

Source: Pitchbook 2nd Quarter 2025 Global M&A Report.

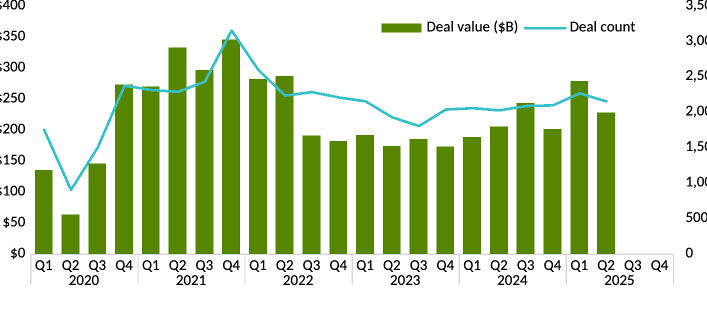

U.S. PE Equity Activity Down Sequentially but Up YOY

According to Pitchbook, U.S. private equity deal flow in terms of deal count was down sequentially in 2Q25 by 5% as compared to 1Q25 but up year over year by 6.3% as compared to 2Q24.

Source: Pitchbook 2nd Quarter 2025 U.S. Private Equity Breakdown.

Year to date through 2Q25, the number of U.S. private equity deals was 4,429, which represents an 8.2% increase YOY as compared to 1H24. The dramatic slowdown in April and May this year was followed by a June rebound as trade policy visibility improved, particularly as related to China.

Most economists have lowered the chance of a recession this year to below 50%. While the consumer segment may continue to feel pressure as households confront tighter conditions, B2B manufacturers, distributors and services companies should fare better as supply chains clear and tariff risks recede.

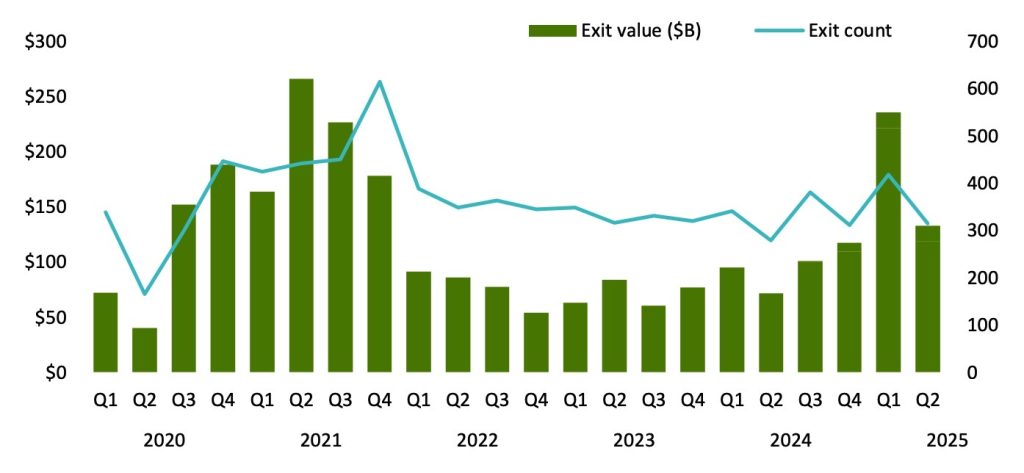

U.S. Private Equity Exit Activity Drops Precipitously

According to Pitchbook, the number of PE exits in 2Q25 hit its lowest mark in the last 12 months, with an estimated 314 exits. This represents a 24.9% decline in count as compared to 1Q25 and the number of exits in 2Q25 dropped below the pre-pandemic quarterly average. However, the PE industry is still on pace for a decent year in exits when annualizing 1H25 activity.

Logjam:

The U.S. PE portfolio company inventory has grown to 12,552 companies through 2Q25, translating to an 8.5-year inventory at the annualized pace of exits in 1H25. Improvement in exit markets needs to broaden to below “A quality” assets if PE firms are going to successfully reduce their inventory of assets. It is getting later in the year, however, for the M&A market to support the acceleration in exits they so desperately need to keep their LPs satisfied.

Source: Pitchbook 2nd Quarter 2025 U.S. Private Equity Breakdown.

Longer Hold Times:

The current inventory of PE-backed assets is getting older as exit activity struggles. The median hold time of exited companies peaked in 2023 at seven years and has since decreased by a year to a median hold time of six years through the first half of 2025, although it remains above the pre-pandemic median of 5.2 years.

In terms of number of exits, PE exits to corporates made up 47% of PE exits in 2Q25 while 53% were sold sponsor to sponsor. Although M&A remains an important growth strategy for companies, corporations are likely waiting for further clarity on how tariffs, policy changes, and inflation will impact their operations. Corporate strategics will be more cautious about pursuing PE-backed assets in the near term as companies continue to navigate market uncertainty.

M&A Market Outlook

Deal flow began to bounce back in the latter part of the 2nd quarter with tariff and economic uncertainty both alleviating at least to some extent. The boom many were expecting, however this year likely will not transpire until 2026. Many companies are still working through the impact of tariffs on their businesses. There are also several sectors sensitive to interest rates so if the Fed does in fact begin to lower rates in the 4th quarter as many expect, that should also drive more deal flow.

We are seeing several strong companies who would be very attractive acquisition candidates holding off on coming to market because they are not confident the market is strong enough yet to get the premium valuations they are looking for and since they are in no rush. No one should be compelled to go to market before they are ready but because high quality deals continue to be scarce, what those owners are missing is that in this environment, they could in fact get a premium valuation especially given the amount of dry powder that remains available to buyers.